High-Rate Taxpayers: Your Wealth Management Options with Rising Taxes

High-rate taxpayers will have noticed the increasing burden on their finances due to the changing tax landscape. As we entered the new fiscal year, the UK embarked on a six-year freeze in income tax thresholds, resulting in a significant shift in the number of individuals falling into higher tax brackets.

In this article, we aim to provide you with a comprehensive understanding of this transformation in the UK tax system over the past four decades. We’ll explore key findings that reveal the growing percentage of adults paying higher rates of income tax, affecting not only the traditionally affluent but also professionals such as nurses, teachers, and electricians.

- The UK is currently experiencing a six-year freeze in income tax thresholds, leading to a significant increase in the number of high-rate taxpayers.

- This report examines the historical transformation of higher tax rates in the UK tax system over the past 40 years.

- Key findings indicate a substantial rise in the percentage of adults paying higher tax rates and the inclusion of previously unaffected professions such as nurses, teachers, and electricians.

- The freeze in income tax thresholds will result in a 1.4% decrease in real household disposable income by 2027–28, eroding a significant portion of potential income growth.

At Questa, we believe it’s important to stay informed about these changes to make informed financial decisions and safeguard your wealth. We’ll provide expert insights and practical recommendations to help you navigate the shifting tax landscape successfully. From tax-efficient investment strategies to maximising tax allowances and exploring pension contributions, we’ll cover a range of wealth management options tailored to high-rate taxpayers in the UK.

It’s essential to remember that each individual’s financial situation is unique, and seeking professional financial advice is important when developing a personalised wealth management plan. Our aim is to equip you with the knowledge and tools necessary to make informed decisions about your finances and adapt to the changing tax environment.

The Broadening Scope of Higher Rates

Over the past four decades, the UK tax system has undergone a remarkable transformation, significantly expanding the reach of higher tax rates. Gone are the days when the higher-rate tax was reserved for a select few; today, it impacts a substantial proportion of the population, including individuals in professions traditionally not associated with high incomes.

To understand the extent of this transformation, let’s examine the key findings that shed light on the increasing number of high-rate taxpayers in the UK.

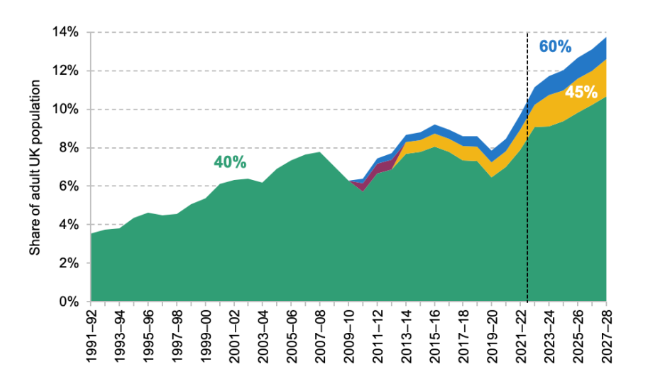

In 1991–92, a mere 3.5% of UK adults paid a 40% higher rate of income tax. Fast forward to 2022–23, and that figure surged to 11%. What’s more, projections indicate that by 2027–28, an astonishing 14% of adults will be paying higher rates, with 3.1% of them facing marginal tax rates of either 45% or 60%. These figures closely rival the share of adults who paid a 40% higher rate back in the early 1990s.

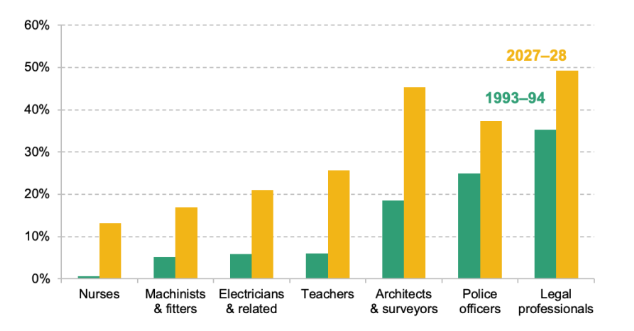

One particularly striking consequence of this shift is the impact on certain professions. In the 1990s, it was rare for nurses and teachers to find themselves subject to higher-rate tax. However, due to income tax thresholds failing to keep pace with average wages, the landscape has changed dramatically. By 2027–28, more than one in eight nurses and one in four teachers are expected to fall into the higher-rate taxpayer category. This demonstrates how even those in vital public service roles are now grappling with the implications of higher tax rates.

The driving force behind the acceleration in the number of higher-rate taxpayers is the government’s decision to freeze income tax thresholds. By the final year of the freeze (2027–28), it will represent the most significant tax increase since VAT was raised to 15% in 1979. Unfortunately, this freeze comes at a cost to real household disposable income (RHDI). By 2027–28, RHDI is projected to be 1.4% lower than if the personal allowance and higher-rate threshold had been adjusted for inflation. This reduction effectively wipes out approximately one-third of the potential growth in RHDI during the freeze period.

Source: https://ifs.org.uk/publications/deepening-freeze-more-adults-ever-are-paying-higher-rate-tax

To grasp the full picture, let’s examine the chart above, which provides a clear visual representation of the changing share of the adult UK population paying higher and additional rates of income tax. The chart also highlights the marginal rate of income tax individuals face on an additional £1 of income. The inclusion of the 60% marginal tax rate, which applies to taxpayers with an income exceeding £100,000, showcases the additional challenges faced by high earners. With these factors in mind, it becomes evident that the tax burden is not evenly distributed, and a considerable segment of the population is subject to higher rates of taxation.

The next chart offers concrete insight into the impact on specific occupations. It illustrates the percentage of employees in selected professions paying higher-rate tax in 1993–94 compared to projections for 2027–28.

Source: https://ifs.org.uk/publications/deepening-freeze-more-adults-ever-are-paying-higher-rate-tax

The figures reveal significant increases across various occupations, including nurses, machinists, electricians, and teachers. For instance, by 2027–28, more than one in eight nurses and one in four teachers are expected to be classified as higher-rate taxpayers. The data clearly demonstrates the broader scope of higher rates, affecting professionals from diverse backgrounds and income levels.

Best Wealth Management Options for High-Rate Taxpayers

Given the shifting tax landscape and the increasing burden on high-rate taxpayers, it is crucial to explore the best wealth management options available. By implementing effective strategies, you can mitigate the impact of rising taxes and safeguard your financial well-being. Here are some key considerations and recommendations to help you navigate this challenging environment:

- Tax-Efficient Investment Strategies: As a high-rate taxpayer, you should optimise your investment approach to minimise tax liabilities. Consider tax-efficient investment vehicles such as Individual Savings Accounts (ISAs), which provide tax-free growth and income. ISAs offer a range of options, including cash ISAs and stocks and shares ISAs, allowing you to tailor your investment strategy to your risk tolerance and financial goals.

- Maximise Tax Allowances: Take full advantage of available tax allowances to reduce your taxable income. Explore options such as pension contributions, which offer tax relief based on your marginal tax rate. By maximising your pension contributions, you not only benefit from tax advantages but also contribute to long-term retirement planning.

- Pension Planning: Pensions play a crucial role in wealth management, particularly for high-rate taxpayers. Explore the various pension options available, such as self-invested personal pensions (SIPPs), which offer greater control and flexibility over your investment choices.

- Seek Professional Financial Advice: Navigating the complexities of wealth management and tax planning requires expertise. Consult with a qualified financial adviser who specialises in working with high-rate taxpayers. They can assess your specific circumstances, goals, and risk tolerance to develop a tailored wealth management plan that optimises tax efficiency and helps you achieve your financial objectives.

- Consider Inheritance Tax Planning: High-rate taxpayers should also consider estate planning and inheritance tax (IHT) mitigation strategies. This may involve making use of annual exemptions, setting up trusts, or gifting assets to reduce the impact of IHT on your wealth. Professional advice is crucial to ensure compliance with relevant regulations and make informed decisions about estate planning.

- Diversify Your Portfolio: Maintaining a diversified investment portfolio is crucial for long-term wealth management. By spreading your investments across different asset classes and geographical regions, you can mitigate risk and potentially enhance returns. Regularly review your portfolio to ensure it aligns with your goals and risk tolerance.

Remember, these recommendations are general in nature and may not be suitable for everyone. Each individual’s financial circumstances and goals are unique, so it’s important to consult with a professional financial adviser like the team at Questa, who can provide personalised advice tailored to your specific needs.

By implementing these strategies and staying proactive in your wealth management approach, you can navigate the challenges posed by rising taxes and ensure the preservation and growth of your assets.

(Note: The information provided in this section is for informational purposes only and should not be considered as financial advice. Consult with a qualified financial adviser before making any investment or wealth management decisions.)

Summing Up

The past four decades have witnessed a remarkable transformation in the UK tax system, with higher rates of income tax impacting a significantly larger portion of the population. What was once reserved for a privileged few has now expanded to encompass professionals across various occupations and income levels. While the government’s priorities around work incentives and redistribution may have driven this change, the freeze in income tax thresholds and the resulting tax burden on high-rate taxpayers require careful consideration and proactive wealth management strategies.

As we’ve explored throughout this article, the freeze in income tax thresholds is projected to have a significant impact on real household disposable income. By 2027–28, households can expect a 1.4% reduction compared to what it would have been if the thresholds had kept pace with inflation. This reduction erodes a substantial portion of potential income growth, emphasising the need for strategic financial planning.

Fortunately, there are steps high-rate taxpayers can take to navigate the changing tax landscape successfully. By employing tax-efficient investment strategies, maximising tax allowances, and exploring pension planning options, you can optimise your financial position and minimise tax liabilities. It’s essential to leverage the expertise of professional financial advisers who can provide personalised advice based on your specific circumstances and goals.

Moreover, as the tax system becomes increasingly complex, it’s crucial to stay informed about the implications of marginal tax rate spikes and the potential distortions they create in taxpayer behaviour. Reviewing your wealth management plan regularly and adapting it to evolving tax policies and regulations is essential for long-term financial success.

While the broadening scope of higher tax rates reflects the changing priorities of the UK tax system, freezing thresholds without considering inflation rate fluctuations is not a sustainable approach to tax policy. It is important for policymakers to evaluate the impact of tax measures on taxpayers’ disposable income and strive for a fair and balanced system that promotes economic growth and incentivises work.

High-rate taxpayers face unique challenges in managing their wealth amidst rising taxes. By implementing effective wealth management strategies, seeking professional financial advice, and staying informed about changing tax policies, you can navigate these challenges successfully and secure your financial future.