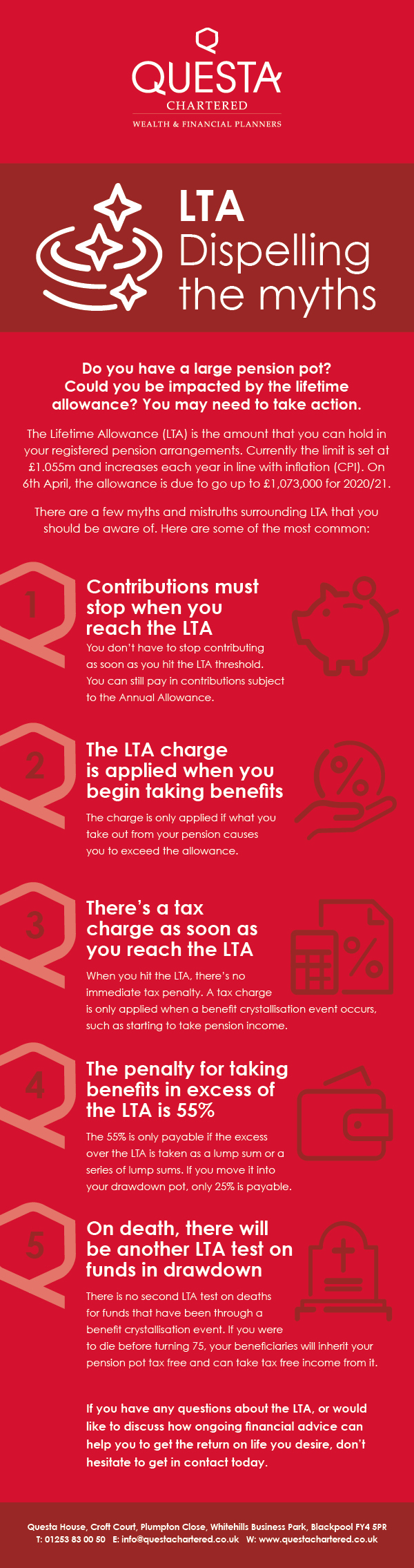

LTA – dispelling the myths

Do you have a large pension pot? Could you be impacted by the lifetime allowance? You may need to take action.

The Lifetime Allowance (LTA) is the amount that you can hold in your registered pension arrangements. Currently, the limit is set at £1.055m and increases each year in line with inflation (CPI). On 6th April, the allowance is due to go up to £1,073,000 for 2020/21.

There are a few myths and mistruths surrounding LTA that you should be aware of. Here are some of the most common:

1 – Contributions must stop when you reach the LTA

You don’t have to stop contributing as soon as you hit the LTA threshold. You can still pay in contributions subject to the Annual Allowance.

2 – The LTA charge is applied when you begin taking benefits

The charge is only applied if what you take out from your pension causes you to exceed the allowance.

3 – There’s a tax charge as soon as you reach the LTA

When you hit the LTA, there’s no immediate tax penalty. A tax charge is only applied when a benefit crystallisation event occurs, such as starting to take pension income.

4 – The penalty for taking benefits in excess of the LTA is 55%

The 55% is only payable if the excess over the LTA is taken as a lump sum or a series of lump sums. If you move it into your drawdown pot, only 25% is payable.

5 – On death, there will be another LTA test on funds in drawdown

There is no second LTA test on deaths for funds that have been through a benefit crystallisation event. If you were to die before turning 75, your beneficiaries will inherit your pension pot tax free and can take tax free income from it.

If you have any questions about the LTA, or would like to discuss how ongoing financial advice can help you to get the return on life you desire, don’t hesitate to get in contact today.